To 401k Rollover or Not to 401k Rollover

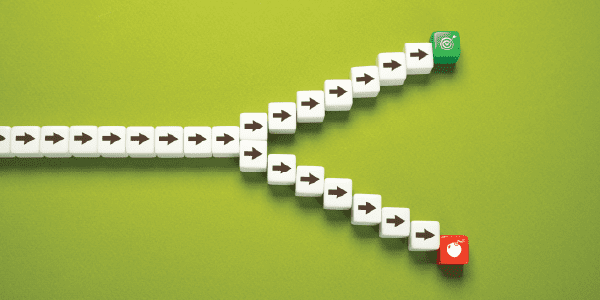

You leave your job, and a note hits your inbox: You’re eligible to roll over your 401(k). Sounds important, maybe even urgent. But what does it mean? And is it the right move?

That’s the thing no one tells you. It depends.

Rolling over retirement funds isn’t just a clerical move. It can change your fees, limit (or expand) your investment options, and impact your asset protection. It’s one of those financial decisions that seems simple on the surface but carries long-term consequences underneath.

Let’s walk through the key factors so you can feel informed — and in control — before taking the next step.

Fees: what you don’t see can still cost you

Every 401(k) plan has fees. Some are for administration, recordkeeping, and custody. Others are for investment advisory services and are included in the investment options themselves. The good news? If your plan was with a large employer, they may have negotiated lower costs on your behalf.

If you’re considering rolling over an old 401(k) into your new employer’s plan, review the fee structure. It might save you money to roll over… or to stay put.

If you’re considering an IRA instead, you avoid administrative fees unless you’re working with an advisor. If you are, the question becomes: Are you getting enough value to justify the cost? A good advisor will help you grow and protect your wealth, making the fee a wise investment, not just an expense.

While rollover recommendations may be subject to Department of Labor rules under PTE 2020-02, OpenPlan’s flat-fee model means that we do not receive variable compensation based on your decision.

Investment options: Freedom can be empowering or overwhelming

401(k) plans typically offer a curated list of investment options, which may include managed portfolios or target-date funds. Managed options and target-date funds can be great if you want a “set it and forget it” approach.

On the other hand, IRAs offer nearly unlimited choice. This “open architecture” lets you access a wider array of funds and strategies. But with more choice comes more responsibility—and sometimes, more confusion.

A trusted advisor can help you build a portfolio that aligns with your goals and risk tolerance, without the noise. If you’re a high earner hoping to make backdoor Roth IRA contributions, having money in a traditional IRA can limit your ability to do so. This is a key planning consideration, especially for those looking to optimize long-term tax strategies.

Asset protection: Don’t trade safety for simplicity

Your 401(k) doesn’t just offer investment benefits—it’s also one of the most protected places to store your money. Thanks to federal law, your 401(k) assets are shielded from creditors.

IRAs, by contrast, don’t offer the same blanket protection. While federal bankruptcy law still protects you, consult a legal counsel for state-specific asset protection rules. If you’re ever sued or face financial hardship, those rules matter, so make sure you understand your state’s laws.

Cashing out your 401(k) outright? That’s where you’re most exposed. You lose tax advantages and protection, and pay income taxes and penalties unless you qualify for an exception.

You don’t have to know everything. You need a trusted partner

Rollover decisions aren’t just about moving money. They’re about protecting your future. And that’s where OpenPlan can help. We’re here to provide you with personalized, proactive advice—so you understand all your options, avoid potential missteps, and feel confident in the plan you choose.

Whether you’re leaving a job, turning 59½, or simply trying to make the most of what you’ve worked hard to save, you don’t need millions to deserve strong financial guidance. You need a partner who sees the whole picture.

This content is for informational and educational purposes only and should not be construed as individualized advice or a recommendation for any specific product, strategy, or course of action. Brighton Jones, its affiliates, and employees do not provide personalized investment, financial, tax, or legal advice through this communication. This material is not intended to, and does not, create a fiduciary relationship under ERISA or any other applicable law. For individualized advice tailored to your specific circumstances, please consult with your adviser.