Consolidating Retirement Accounts: Handling Multiple Accounts

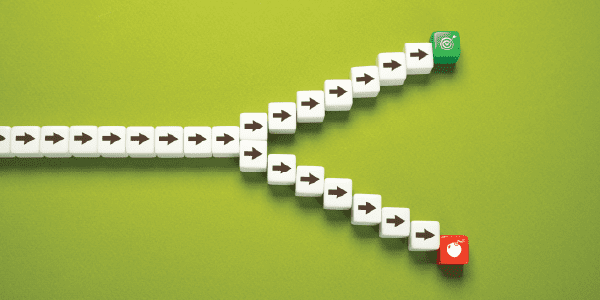

If you’ve changed jobs a few times — and who hasn’t? — you may have left behind a trail of retirement accounts. A 401(k) here, a traditional IRA there, maybe even a Roth from that short-term consulting gig. It might not seem urgent, but letting those accounts linger without attention can create headaches later on. Consolidating retirement accounts may result in unnecessary fees, overlapping investments, and missed opportunities for your money to work harder for you.

How it happens

It’s completely normal. Every time you start a new job, you’re offered a new retirement plan. Over time, these accounts pile up. Add in rollovers or a backdoor Roth, and suddenly your retirement picture starts to look like a junk drawer — everything’s in there, but good luck finding what you need.

Why consolidation helps

Bringing those old accounts together — whether by moving them into IRAs (separate Traditional and Roth accounts, as needed) or your current employer’s — may help simplify your financial life. You’ll gain a clearer view of your total retirement assets and how they’re invested, making it easier to assess whether your portfolio is balanced and on track.

You might also save money. Some old accounts continue to charge administrative fees, or hold mutual funds with high expense ratios. When you consolidate, you can generally select lower-cost investment options that align with your long-term strategy.

Just be thoughtful about where you move the money. Some 401(k) plans offer strong creditor protections, while IRAs typically provide more investment flexibility. It’s important to weigh your options—or better yet, get help from a financial advisor to help you understand your options and avoid potential pitfalls, such as tax consequences or loss of account benefits.

One more thing: Check your beneficiaries

Each retirement account you open includes a beneficiary designation. If you haven’t reviewed those in a while, now’s the time. Consolidating your accounts is a great opportunity to update and streamline these designations so they reflect your current wishes—and avoid legal complications down the road.

It’s about more than clean-up

Consolidation isn’t just about having fewer accounts. It’s about having a more cohesive retirement strategy. When your assets are aligned and easier to monitor, it’s easier to make intentional decisions about your future — how much risk to take, when you can afford to retire, and what kind of legacy you want to leave.

Working with a financial advisor can help you do more than tidy things up. It’s an opportunity to connect the dots between your values, goals, and wealth.

Take back control

This is your reminder that retirement planning doesn’t have to be messy or overwhelming. A few intentional steps now may give you a clearer path forward — and one less thing to worry about when you’re ready to start that next chapter.

This content is for informational and educational purposes only and should not be construed as individualized advice or a recommendation for any specific product, strategy, or course of action.Brighton Jones, its affiliates, and employees do not provide personalized investment, financial, tax, or legal advice through this communication. This material is not intended to, and does not, create a fiduciary relationship under ERISA or any other applicable law. For individualized advice tailored to your specific circumstances, please consult with your adviser.