Tax-Advantaged Retirement Accounts

Saving for retirement isn’t just about discipline — it’s about strategy. Choosing the right accounts may help significantly reduce your tax burden and increase your long-term growth. Here’s what you need to know about tax-advantaged options.

Traditional vs. Roth

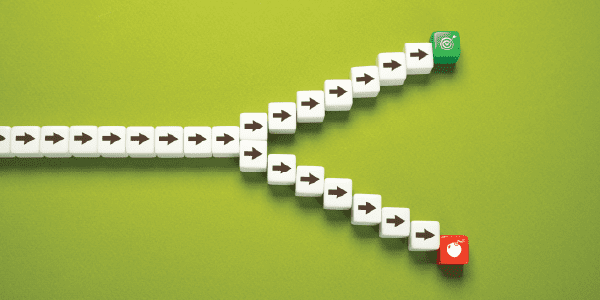

Choosing between the two depends on your current vs. expected future tax rate. Traditional 401(k)/IRA contributions are pre-tax, lowering your current taxable income, while withdrawals are taxed in retirement. In contrast, Roth 401(k)/IRA contributions are made with after-tax dollars, but withdrawals are tax-free if qualified.

Which is better? If you’re early in your career and expect to earn more in the future, Roth accounts may be a great choice. You pay taxes now while you’re in a lower bracket, and your money grows tax-free for decades. If you’re mid-career and earning more, you might benefit from Traditional contributions to reduce your current tax bill. Some people do both to create flexibility later. That’s called tax diversification — a concept your future self will thank you for.

Health Savings Accounts (HSAs)

An HSA may not seem like a traditional retirement account, but it’s often referred to as the most tax-advantaged account available. Here’s why:

- Contributions are tax-deductible

- The account grows tax-free

- Withdrawals for qualified medical expenses are tax-free

Plus, after age 65, you can use HSA funds for anything, though non-medical withdrawals are taxed like a Traditional IRA. If enrolled in a High Deductible Health Plan (HDHP), consider maxing out your HSA and letting it grow. Think of it strategically as a supplemental retirement tool.

SEP and SIMPLE IRAs

If you freelance, run your own business, or earn side income, don’t overlook SEP IRAs, SIMPLE IRAs, or Solo 401(k)s. These tax-advantaged accounts offer higher contribution limits than a regular IRA and can be easier to manage than a full employer 401(k) plan. Contributions are tax-deductible and grow tax-deferred, making them powerful tools for long-term wealth building.

A SEP IRA allows employers — including sole proprietors — to contribute up to 25% of their income, making it a flexible option for high-earning years. A SIMPLE IRA enables both employer and employee contributions and is particularly well-suited for small businesses with a handful of employees. A Solo 401(k) is designed specifically for business owners with no employees other than a spouse. It offers the highest potential contribution limits by combining employee salary deferrals with employer profit-sharing. It also stands out for allowing Roth contributions and participant loans, giving solo entrepreneurs more flexibility.

What if I change jobs?

If you’re like most professionals, you won’t stay with one employer forever. So what happens to your 401(k)? You can usually roll it into a new employer’s plan or into an IRA. A financial advisor may be able to help you avoid tax mistakes and consolidate accounts for simplicity.

Can I access this money early?

Retirement accounts are usually off-limits until age 59½, though some exceptions exist:

- Roth IRA contributions (not earnings) can be withdrawn anytime, tax-free

- HSAs can be tapped for medical expenses without penalty

- 401(k) hardship withdrawals or loans are possible, but come with strings attached

- You can withdraw traditional IRA contributions before 59½, but you will pay ordinary income taxes, along with a 10% early withdrawal penalty, on any amounts taken out.

Knowing the rules helps you avoid penalties and make informed decisions if life takes a turn.

Align your strategy with your life

At the end of the day, choosing the “best” account isn’t about beating the system — it’s about designing a system that works for you. A well-balanced mix of tax-deferred, tax-free, and taxable accounts may give you options. And flexibility is the real superpower when it comes to your future.

If you’re unsure where to start, talk to a financial advisor who can help you align your accounts with your goals — and your life.

This content is for informational and educational purposes only and should not be construed as individualized advice or a recommendation for any specific product, strategy, or course of action. Brighton Jones, its affiliates, and employees do not provide personalized investment, financial, tax, or legal advice through this communication. This material is not intended to, and does not, create a fiduciary relationship under ERISA or any other applicable law. For individualized advice tailored to your specific circumstances, please consult with your adviser.